Sport-anchored precincts like Battery Atlanta, Singapore Sports Hub, and emerging projects in London and Detroit have shown investors that mixed-use developments centred on sports venues can deliver extraordinary returns. Now, Dwarka, with The Omaxe State, is positioning itself as India’s next homegrown example of this model.

1. Why Sports Precincts Attract Investors

Consistent Footfall

- Battery Atlanta hosted 8.7 million visitors in 2024. Tenants collectively earned $130 million in retail revenue that year

- Braves Holdings reported 14% YoY growth in mixed-use revenue—reaching $67 million in 2024—and 23% growth in Q1 2025 alone (mixed-use revenue of $19M)

- These precincts generate consistent foot traffic every day, not just during sports events.

Sustainable Revenue Streams

- Retail, hospitality, events, parking, offices, and fast-casual restaurants combine multiple income streams.

- Battery Atlanta pays off proportionally even during non-game days—its mixed-use component delivered $45M in adjusted EBITDA in 2024. Tax benefits too: Cobb County’s annual tax revenue jumped to $38 million by 2022, up from almost zero pre-development

- Property Value Appreciation In 2014, The Battery's property value was roughly $5 million; by 2022, it soared to $736 million

- These precincts also spur spillover growth in nearby real estate, benefiting the wider local economy.

2. Singapore Sports Hub: A Regional Powerhouse

- The 55,000-seat National Stadium, along with indoor arenas, aquatics, retail, and F&B venues, covers 35 hectares in Kallang. In 2023, Singapore recorded $22.4 billion in tourism receipts—up 10% YoY from Jan–Sep, with entertainment and sightseeing up 25%

- Major concerts like Coldplay and Taylor Swift helped the Sports Hub draw over 1 million visitors in just early 2024, contributing toward an estimated S$450 million ($330M) economic injection

Investor Insight: When governments and private partners commit to well-designed sports precincts, they unlock tourism dollars, create thousands of jobs, and build lasting lifestyle assets.

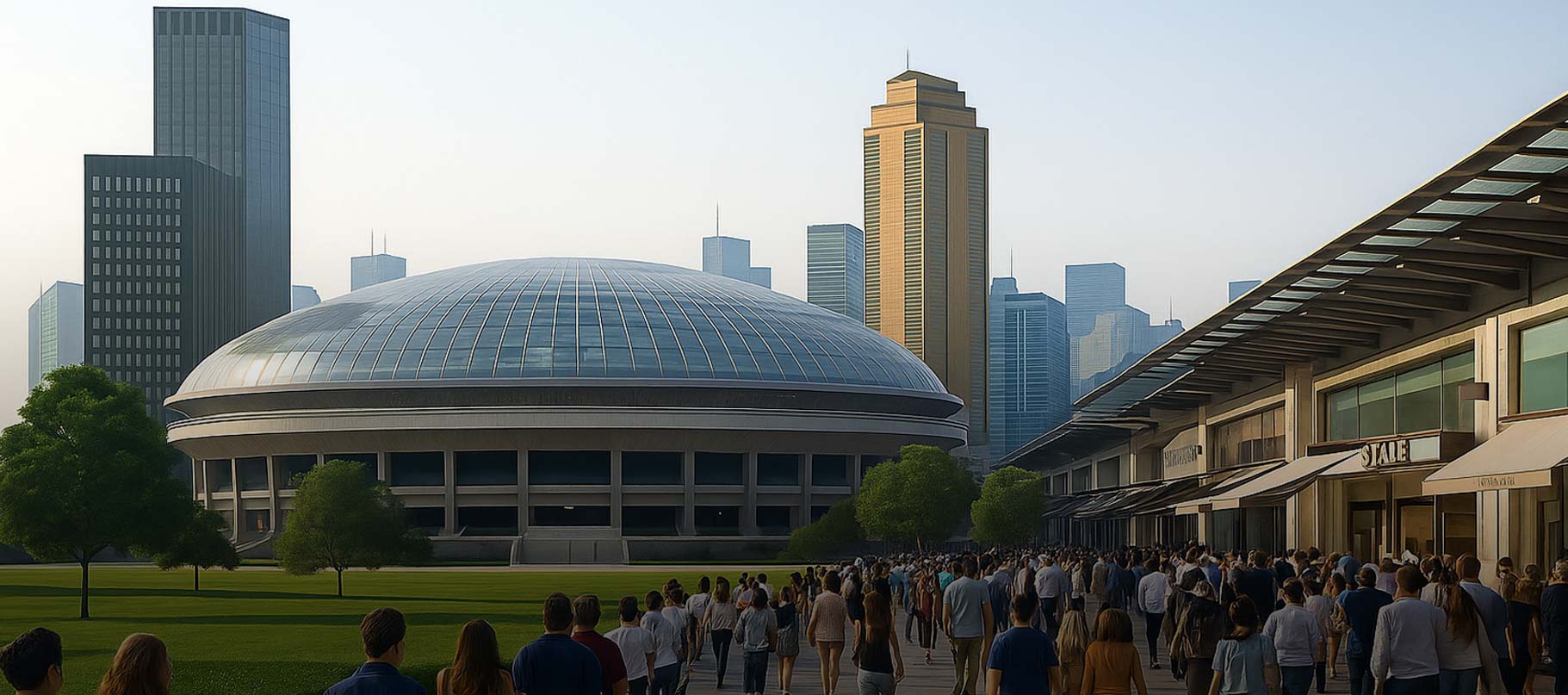

3. The Omaxe State, Dwarka: India’s Emerging Capital of Footfall

Project Overview

- A ₹2,500 crore, 50-acre PPP in Sector 19B, Dwarka—Omaxe holds a 99-year lease and aims to open by 2027.

- Includes a 30,000-seat ICC/FIFA-standard stadium, 2,000-capacity indoor arena, 75,000 sq ft e-sports zone, movie theatre, high-street retail, 500,000+ sq ft F&B, a 148-key hotel, multi-sport courts, parking, and support facilities.

- Expected lifetime revenue: ₹4,200 crore.

Investment Thesis

- Footfall-driven economics: With metro, road, and airport links, daily visit numbers—even outside event days—will make this precinct a retail hotspot.

- Diversified returns: Evaluating sports ticketing, retail rental, F&B turnover, hospitality bookings, and sponsorships together brings portfolio resilience.

- Value uplift: Similar to global models, Dwarka’s surrounding real estate will likely see price appreciation as infrastructure and amenities improve.

4. What Investors Should Know

Multi-Stream Earnings

Sports precincts don’t rely on a single revenue source. Dwarka’s mix of stadium events, e-sports, cinema, shopping, hotels, and restaurants mirrors winning international models and spreads risk.

Daily Recurring Visits

With strong transport connectivity and integrated leisure options, precincts maintain vibrant footfall levels, translating into dependable retailer and investor income.

Economic & Civic Gains

Projects like Battery Atlanta funded school boards, improved infrastructure, and generated tens of millions in tax and tourism income. Dwarka’s model can replicate this, benefiting local families and government finances.

First-Mover Advantage

This will be India’s first fully integrated sports-anchored destination. Early investors and tenants can capture branding, leasing and market advantage.

5. Bottom Line: Why Now Is the Time

- Global validation: Data from Atlanta, Singapore, London, and Dubai prove the asset class works.

- Policy tailwinds: The Indian government’s “Fit India” and urban transformation initiatives support such projects.

- Dwarka’s readiness: Transit, population, and civic support offer the perfect launchpad.

- Revenue diversity: Sports, events, hospitality, retail, e-sports, sponsorship—this model brings robust upside even during economic slowdowns.

Why should you invest in Dwarka?

If you're evaluating real estate with high-yield and long-term stability, sports-led mixed-use precincts, now emerging in Dwarka, offer a compelling value proposition. This is the moment India catches up to global benchmarks.